From mountain landscapes to cosmopolitan cities, Canada offers iconic locations accompanied by generous incentives

Besides Canada’s internationally recognized film locations (Vancouver, Toronto and Montreal), the Great White North has a wealth of movie locations across its picture-perfect provinces. Location scouts can create cinematic magic with any genre, from the boreal forest to the Toronto skyline, and receive financial relief through the Canadian Film Production Tax Credit.

Be sure to Subscribe for FREE to Destination Film Guide and Download the Magazine for FREE to uncover more unique production content and expert resources.

Alberta Film Production Incentives

Alberta is a Canadian province situated in the Western part of the country. While its capital city, Edmonton, is a good option for scouts looking for an urban backdrop, Alberta also has a diverse terrain ideal for nature shots. The landscape encompasses mountains, prairies, desert badlands, and evergreen forests. Noteworthy blockbusters shot in Alberta are Ghostbusters: Afterlife (2021), Land (2021), and Inception (2010).

Incentive Type: Refundable Tax Credit

Incentive Amount: 22% – 34.5%

Minimum Spend: $500K

Bonus: Contact the film office.

Audit: Yes

Application: All applications must be submitted through the online application portal. Principal photography must not have started before an application is submitted to the program. Once an applicant has received an Authorization Letter, they must begin principal photography on the production within 6 months after the date of issuance of

the Authorization Letter.

Sunset Date: None

British Columbia Filming Benefits

British Columbia, Canada’s Westernmost province, is defined by a scenic Pacific coastline and majestic mountain ranges. Vancouver is also located in BC and holds Sony’s headquarters. For more production opportunities, explore locations outside Vancouver, including Victoria, the Okanagan Valley and Whistler and Blackcomb Mountains. If you’re a scout looking for cutting-edge technology for special effects, BC is internationally recognized as a special effects hub.

Be sure to Subscribe for FREE to Destination Film Guide and Download the Magazine for FREE to uncover more unique production content and expert resources.

Incentive Type: Refundable Tax Credit

Incentive Amount: 36% – 46.2%

Minimum Spend: $1M (film); $200K CAD (TV per episode ≥ 30 mins); or $100K CAD (TV per episode < 30 mins)

Bonus: Contact the film office.

Audit: No

Application: Corporations must apply for a pre-certification number by submitting a pre-certification form through Creative BC’s website within 120 days after the date the corporation first incurs an accredited BC labor expenditure on the production.

Sunset Date: None

Manitoba Film Production Benefits

Manitoba’s landscape will make your viewers fall in love with nature. Its wide-open expanses are made up of lakes and rivers, mountains and boreal plains. This province is well-suited for professionals in the film industry. Winnipeg, Manitoba’s capital city, brings thousands of filmgoers together through its annual Gimli International Film Festival. Films you may have seen filmed in Manitoba include The Lookout (2007), Paycheck (2003), and Resident Evil: Apocalypse (2004).

Be sure to Subscribe for FREE to Destination Film Guide and Download the Magazine for FREE to uncover more unique production content and expert resources.

Incentive Type: Refundable Tax Credit

Incentive Amount: 30% – 53.8%

Minimum Spend: None

Bonus: Contact the film office.

Audit: Yes

Application: Positions to be deemed as eligible MB labor must be identified and communicated to Manitoba Film & Music before the start of principal photography.

Sunset Date: None

Nova Scotia Filming Incentives

Nova Scotia might be one of the smallest Canadian provinces, but it has a bold and rich film history. Surrounded by the Atlantic Ocean and lush with vibrant green vegetation, Nova Scotia has been the source of inspiration for numerous feature films. Some of the award-winning movies made in the province include Titanic (1997), The Shipping News (2001), Amelia (2009), and The Lighthouse (2019).

Be sure to Subscribe for FREE to Destination Film Guide and Download the Magazine for FREE to uncover more unique production content and expert resources.

Incentive Type: Grant/ Rebate

Incentive Amount: 25% – 37%

Minimum Spend: $25K CAD ($18.25K USD)

Bonus: Contact the film office.

Audit: Yes

Application: Applications must be submitted before the start of principal photography.

Sunset Date: None

Ontario Filming Tax Incentives

Ontario is home to Canada’s capital, Ottawa, and Toronto, one of the largest movie hubs in North America. Ontario will support your big picture project with industry connections, exceptional services and financial relief. Popular TV series, including The Handmaid’s Tale and Suits, and blockbuster movies like The Shape of Water and IT Chapter One and IT Chapter Two were partly filmed in Toronto.

Be sure to Subscribe for FREE to Destination Film Guide and Download the Magazine for FREE to uncover more unique production content and expert resources.

Incentive Type: Refundable Tax Credit

Incentive Amount: 21.5% – 34.1%

Minimum Spend: $1M CAD (film); $200K CAD (TV per episode ≥ 30 mins); or $100K CAD (TV per episode > 30 mins)

Bonus: Contact the film office.

Audit: No

Application: The qualifying corporation submits a completed OPSTC Application to Ontario Creates in respect of each eligible production. You can apply for a Certificate of Eligibility at any time during the production (from the start of principal photography or key animation) or after production activities have been completed.

Sunset Date: None

Quebec Filming Production Incentives

Quebec has a rich film history, dating back to the late 1800s. In fact, the first public film projection in North America took place in Montreal. This gigantic Canadian province is nearly three times the size of Texas, with strong French influence and diverse terrain. Films such as Scream VI, John Wick: Chapter 2, and Mother! were partly filmed in the culturally diverse city of Montreal.

Be sure to Subscribe for FREE to Destination Film Guide and Download the Magazine for FREE to uncover more unique production content and expert resources.

Incentive Type: Refundable Tax Credit

Incentive Amount: 25% – 37%

Minimum Spend: $250K CAD ($182.5K USD)

Bonus: Contact the film office.

Audit: No

Application: Applications, along with the associated required documents, must be submitted before the end of the taxation year for which the claim will be made.

Sunset Date: None

Saskatchewan Filming Incentives

Saskatchewan’s weather, brilliant skies and vibrant communities are as varied as its grasslands, forests, rivers, and lakes. The region offers unmatched locations perfect for filming, from the untouched North and sleepy yet charming small towns boasting unique cultures to lively and eclectic city centers. Visit Saskatoon, known as “The City of Bridges,” and glimpse magnificent backdrops of impressive bridges spanning the South Saskatchewan River. History abounds in the capital city of Regina and Swift Current, colloquially known as Saskatchewan’s Sunniest City, offers a rich heritage in the province’s southwestern region.

Be sure to Subscribe for FREE to Destination Film Guide and Download the Magazine for FREE to uncover more unique production content and expert resources.

Incentive Type: Grants / Rebates

Incentive Amount: 25% – 37%

Minimum Spend: None

Bonus: Contact the film office.

Audit: No

Application: Applications for productions in which the majority of principal photography takes place in Saskatchewan can expect to receive results within four weeks from the date of application acceptance. Results will be delivered via e-mail and will be available in GMS.

Sunset Date: None

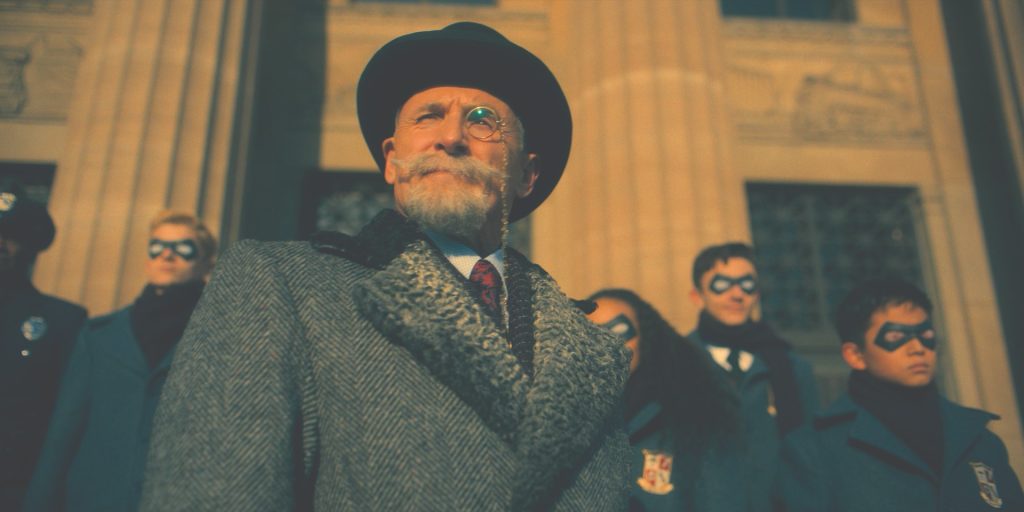

Photo courtesy of Minds Eye Entertainment